5.8. Other Possible Types of Analysis

Apart from the main types of analysis, SMEs can benefit from using other types, depending on their company’s needs:

-

Market Potential Analysis – the purpose of which is to estimate the potential number of sales in a given market. A realistic estimate of the number of products or services sold is an essential tool for ensuring financial viability. Carrying out this analysis also means assessing whether or not the total sales potential of a given product reaches the minimum required amount for the product or service to be profitable in the given market, taking into consideration fixed and variable costs (Keřkovskýk Vykypěl 2006).

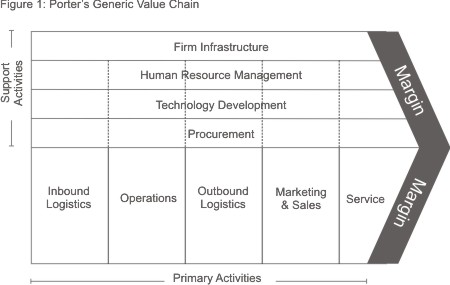

- Value Chain Analysis – the purpose of this analysis is to assess the company’s individual (relatively specific) activities, processes and procedures in terms of how they each contribute towards building the overall perceived value of what the company provides to its customers. This perspective is useful, for example, when optimizing costs – revealing activities or procedures that are implemented by the company out of habit and do not, in their current form, contribute to generating value (in total or in relation to costs allocated for these activities), it can be an effective tool for deciding on cutting costs in the “right places.” Aspects which, according to this approach, should be analyzed are indicated in Figure below. Another interesting perspective offered by the analysis is the suggestion to analyze the value that suppliers as well as distributors either add or take away from the company’s products. Particularly, other related distribution activities and processes may often significantly impact (either positively or negatively) the customer’s overall experience with the product or service (i.e. perceived value). An example of this is poorly executed assembly or installation implemented by a company other than the manufacturer, which may adversely impact the customer’s perception of an otherwise high-quality product (de Witt, Meyer, 1994, Johnson, Scholes, 1993).

Source: Adapted from http://www.mindtools.com/pages/article/newSTR_66.htm

-

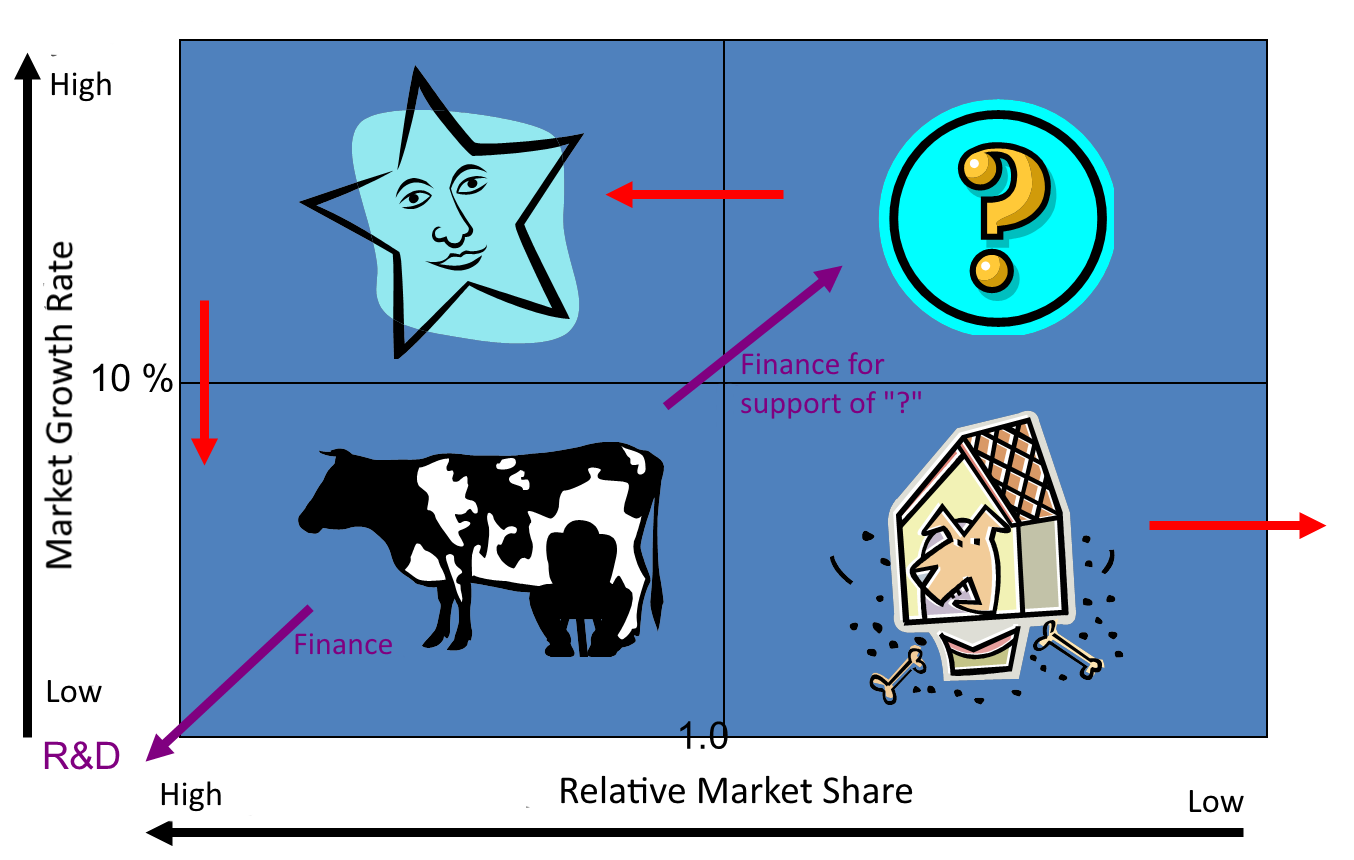

Product Portfolio Analysis – This approach offers an interesting perspective. It suggests assessing the portfolio of products or services from two different perspectives (de Witt, Meyer, 1994):

-

The importance of a given product is in terms of the company’s overall financial performance (the BCG matrix recommends evaluating this in terms of relative market share – since this is difficult to find out or measure for SMEs, it may be assessed instead by e.g. the role of the given product in the company’s total turnover.)

-

How important a given product is in terms of future development (measured by market growth – SME environments once again will not facilitate a precise estimate of market growth or decline. For the purposes of this analysis, an estimate of whether or not the given market will grow or decline is sufficient.)

As a part of this analysis, it is then possible to divide products into four categories which require specific strategic approaches.

-

Star – a product with a promising position, dominant in the market with significant growth potential. However, relatively high investment costs and lower profits are to be expected.

-

Cash Cow – A product with high market share and low growth rates. Ideal. Low investment costs, high profits.

-

Question Mark – A product with low market share and rapid growth. A possible strategy is attempting to convert it into a star product – this however requires large investments. High risk rate.

-

Old Dog – A product with low market share and low growth. Low profit and need for investment. Necessary to liquidate or sell.

Apart from further recommending the strategic development of individual products or services, this analysis can point out the significant risks associated with managing product portfolios. A common risk can be e.g. the risk of gradually converting an important product in the “Cash Cow” category, which finances development and sometimes the economics of other products, into a “Question Mark” or “Old Dog.” If a company finds itself in this situation, one of the strategic benefits will be to arrange a replacement for this product or think of another way to address this financial risk.

-

Financial Analysis (see Valach et al. 1999):

-

Horizontal cost analysis- an analysis of costs – this analysis suggests conducting a detailed analysis of how individual cost items develop over time (e.g. how they developed over the past several years). It is also worth considering growing costs – it is advisable to analyze the reasons for cost growth, and if it is not strategically justified, adopt measures in order to reduce these costs.

-

Vertical cost analysis – this analysis, on the other hand, is based on the percentage of individual costs in relation to the company’s total costs. If the company wishes to optimize costs, this analysis suggests selecting costs which have overall savings potential. This type of analysis can prevent companies from making ill-founded assumptions and laboriously attempting to reduce costs which may in fact have only a minor impact on savings potential.

-

Advertising Investment Analysis – In terms of marketing and communication, the percentage that a company invests into advertising compared to its competition can be analyzed. In certain industries, this data can be purchased. If the company happens to know the competition’s approximate performance (measured e.g. by turnover), the company can, by comparing its own turnover and advertising investments with its competition, conduct a general assessment of how efficiently its investments are being handled (Hanzelková, Keřkovský, Odehnalová, Vykypěl, 2009).

-

Information Analysis – An interesting and relevant analysis for SMEs is an information analysis. It involves assessing how the company manages to acquire key data, which data will be of future use, and the manner in which the company will maintain key data a typical situation in family companies is, for example, when the departure of the owner means the loss of some of the company’s key information – it is precisely this type of information which should be systematically handed over during intergenerational transfers), see for example Truneček (2004).

-

Strategic Triangle Analysis – this analysis suggests thinking about to what extent the structure and culture of the company support, or conversely inhibit, the successful implementation of the strategy. See also Implementation.

-

Generic Strategy Analysis – Companies which have a more complicated strategy (e.g. with several SBUs) can benefit from conducting a simple generic strategy analysis prior to formulating detailed, lower-level strategies (business or functional) – i.e. when formulating the functional strategy, to conduct an analysis of the superordinate business strategy. The aim of this analysis is to identify key requirements in the superordinate strategy (as well as strategic barriers) which will have to be addressed by the lower-level strategy. This analysis thus ensures a harmonious relationship between higher and lower level strategies.