4.3.2. Additional Information

Which Activities Can Purchasing Provide?

Purchasing can provide a wide range of activities for your company. The following overview will allow you to consider and select activities that are suitable for your company (adapted from Červený, Hanzelková, Keřkovský, Němeček, 2013).

ANALYSIS OF PURCHASING MARKETS

- Industry Analysis

- Analysis of Commodities, Raw Materials and Currencies

- Forecasting

SOURCING

- Searching for Suppliers

- Demand and Selection Process

- Negotiating

- Supplier Qualifications and Approval

CONTRACTS

- Creating Standard Contracts

- Negotiating and Approving Contracts

- Contract Management and Termination

- Protection of Intellectual Property and Data

SUPPLIER DEVELOPMENT AND MANAGEMENT

- Supplier Assessment

- Audits

- Improving Suppliers and Reducing Costs

RISK MANAGEMENT

- Identifying and Assessing Risks

- Risk Reduction and Elimination Programs

- Ensuring Compliance with Regulations and Guidelines

QUALITY CONTROL

- Qualification of Supplier Processes

- Qualification of Supplied Products

- Change and Error Management

- Addressing Defects and Quality Improvement

PURCHASING TRANSACTIONS

- Negotiating Orders

- Delivery Tracking

- Managing Delays

LOGISTICS

-

Ordering Transport

-

Packaging

-

Customs Clearance and Documentation

-

Handling Hazardous Materials

-

Inbound Deliveries

-

In-house Transport

PLANNING

-

Demand Planning

-

Monitoring Suppliers’ Capacities

-

Forecasting

INVENTORY MANAGEMENT

-

Inventory Planning

-

Storage

-

Recordkeeping and Inventory

-

Waste Management

PROJECT MANAGEMENT

-

Launching New Products

-

Implementing Information Systems

FINANCE AND BUDGET

-

Calculations and Budgets

-

Cost Analysis

-

Managing Responsibilities towards Suppliers

-

Cost Reduction Projects

-

Make or Buy Decision-Making

How to Optimize Deliveries?

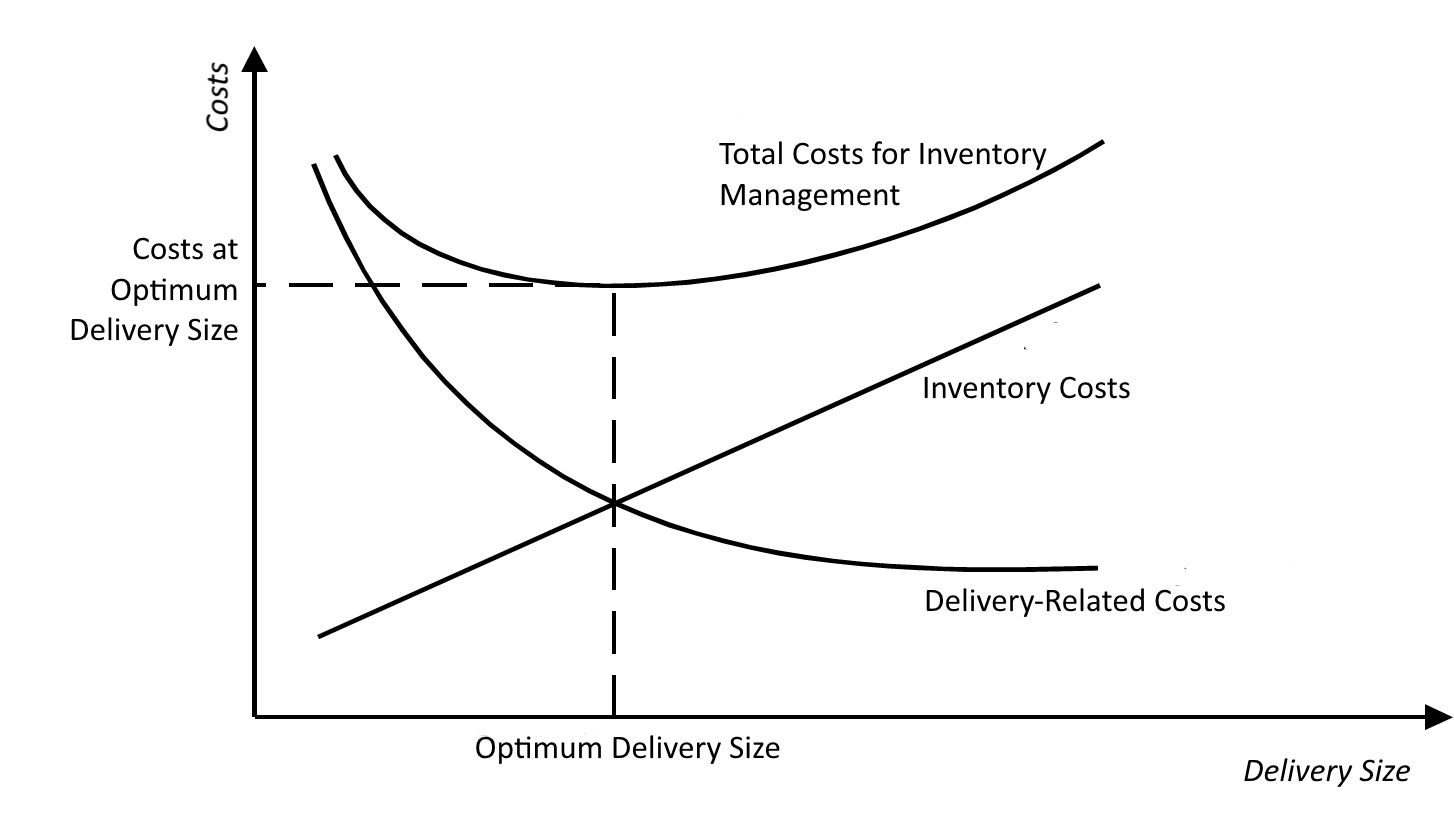

The most common goal, when planning and optimizing deliveries and inventory, is to reduce supply-related costs (Žufan, 2011b). From this perspective, the optimum size of the delivery is one where delivery costs are equal to storage costs (see Fig. below). Other possible criteria for optimizing inventory can be, for example, minimizing the amount of inventory-related costs, maximizing inventory turnover rates (both of these criteria lead to cost reduction), minimizing inventory shortage risks (e.g. an allowance of a 5% probability rate for unmet demands, with a maximum 2 day delivery delay etc.) Even in these models, the ultimate aim is to select a strategy which will maximize profits or minimize costs and losses. Mixed models are also commonly used – for example, an approach where the fundamental aim is to optimize costs, on the basis of which optimal inventory volumes are determined, accompanied by safety stock which is in turn determined based on other criteria (e.g. to cover the average two-day demand).

Inventory Management Model (Horáková, Kubát 1999)

When to Select Centralized and When to Select Decentralized Purchasing? (adapted from Červený, Hanzelková, Keřkovský, Němeček, 2013):

| Advantages | Disadvantages | |

| Centralized Purchasing | Increased specialization and ability to hire the best experts | Superficial knowledge of own products |

| Uniform guidelines and regulations | Generic requirements, lack of detail | |

| Easier access to resources (financial, staff) for long-term development and expansion | Slow decision-making | |

| Volume consolidation and negotiating power | Inability to address specific demands | |

| Closer to senior management | Out of touch with consumers | |

| Option to save money on bulk purchases | Unfamiliarity with other hidden costs and risks | |

| Taking advantage of global opportunities | Impersonal contact with suppliers | |

Decentralized Purchasing |

Better communication with consumers | May be biased due to other functions |

| Quick problem solving | Unfamiliarity with the company’s long-term strategy | |

| Individualization of consumer needs | Small volumes | |

| High technical expertise | Weaker negotiating power | |

| Familiarity with local suppliers | Neglected global opportunities |

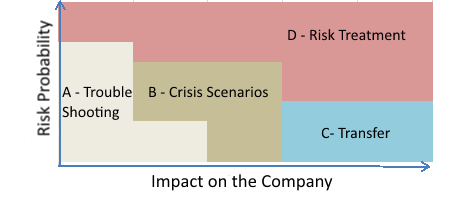

Risk Matrix and Various Management Strategies

From a strategic point of view, purchasing risks can be addressed using the so-called “Risk Assessment Matrix.” The idea behind the risk matrix is that threats (risks) can be assessed based on the extent of the potential loss that certain risks present (the x-axis in the matrix), if a risk occurs, as well as the probability of a given risk (the y-axis in the matrix). Based on the position and type of risk in the matrix, we can observe four basic strategy types for assessing these risks (Zrůst, Pyšný, 2010).

-

Risk Acceptance Strategy defined as “Retention” or “Zero Strategy”, according to Winterling (Winterling, 1992) along with “Trouble Shooting”, is a method that is employed with risks that possess low probability rates and whose damage has minimal impact on the company and is therefore of low consequence.

-

Crisis Scenario Strategy (Planning) – The company plans for the possibility of risks, which are mostly improbable or rare, and whose expected damage may weigh down the company but does not put the company in danger (Winterling, 1992). In this case, the company is aware of the financial implications such a risk may have, accepts them as a possibility and ensures it has a rainy day fund for such situations.

-

Treatment Strategy - is one of the offensive risk management strategies. According to Tichý (Tichý, 2006), risks can be treated either by taking preventive measures to reduce the probability of risks occurring, or by diversifying their potential impact.

-

Risk Transfer Strategy – is one of the defensive risk management strategies where the risk is transferred to a third party. Several methods of treating risks using this strategy are: insurance, including third-party insurance, leasing, factoring and forfaiting, surety bonds and franchises (Janata, 2004).

-

Termination Strategy is an extreme solution, where the damage is so severe and treatment options are so limited, that it is more beneficial to terminate the project or activity or choose not to implement it at all. When deciding on adopting this strategy, it is advisable to consider the adverse impact that terminating certain activities may have on the company (Tichý, 2006).

In practice, it is advisable to consider employing a combination of strategies when assessing a particular risk.

Risk Management Strategy (Zrůst, Pyšný, 2010)

When to Buy, When to Rent, and When to Produce Yourself? (Keřkovský, 2009, Červený, Hanzelková, Keřkovský, Němeček, 2013).

When managing supplies, it is advisable to consider which activities or inputs to purchase, which to rent, and which to make yourself. Each option has its own advantages and disadvantages.

| When to Buy – Advantages of Purchasing | When to rent- Advantages of Renting |

| Total cost for the time of use is generally lower. | I do not have to immediately generate funds |

| I can sell at any time | Payments are considered to be expenses and can have tax benefits. |

| I can use it for a long time, even after it has been written off. | It does not matter if the product becomes physically or technologically obsolete. |

| No fees when you change or prematurely terminate use. | More options are available upon the contract’s expiry. |

| It is your property. It can subjectively improve your company’s appearance. | It does not increase bank loans. It does not adversely impact the liability side. |

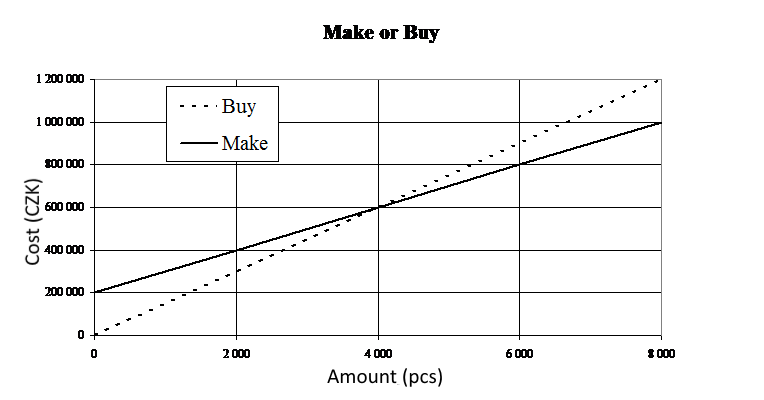

And when should a company make or buy? One method of deciding whether to make or buy inputs is by comparing the costs of these activities. Judging from the graph below, it is clear that both methods vary based on the company’s required input amounts. In this case, it becomes beneficial for the company to make their own inputs when the input amount is 4000 pcs or higher, meaning lower volumes should be bought instead.

Graph no.: Make or Buy (Žufan, 2011a)

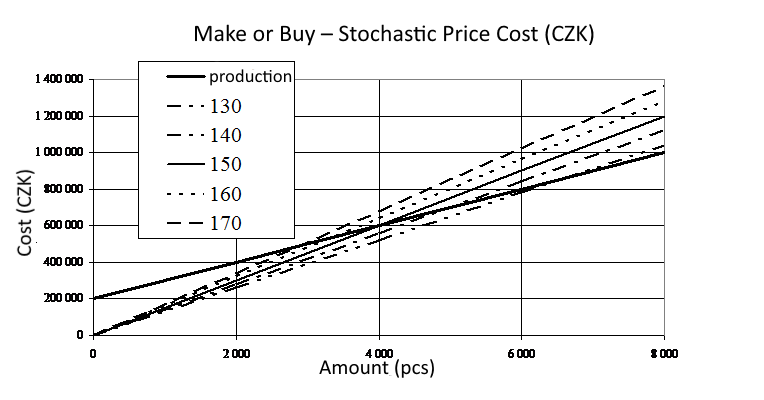

Since it is often problematic to determine future price developments in real life, it is advisable to broaden the scope of this analysis by adding several variations of possible price developments – see graph below. This graph illustrates that depending on different variations of

developments in the purchase price and the production costs of a given input, the minimum required input amount which makes one method more preferable than the other (buying vs. making) can fluctuate.

Make or Buy – various price developments (Žufan, 2011a)

Make or Buy – various price developments (Žufan, 2011a)