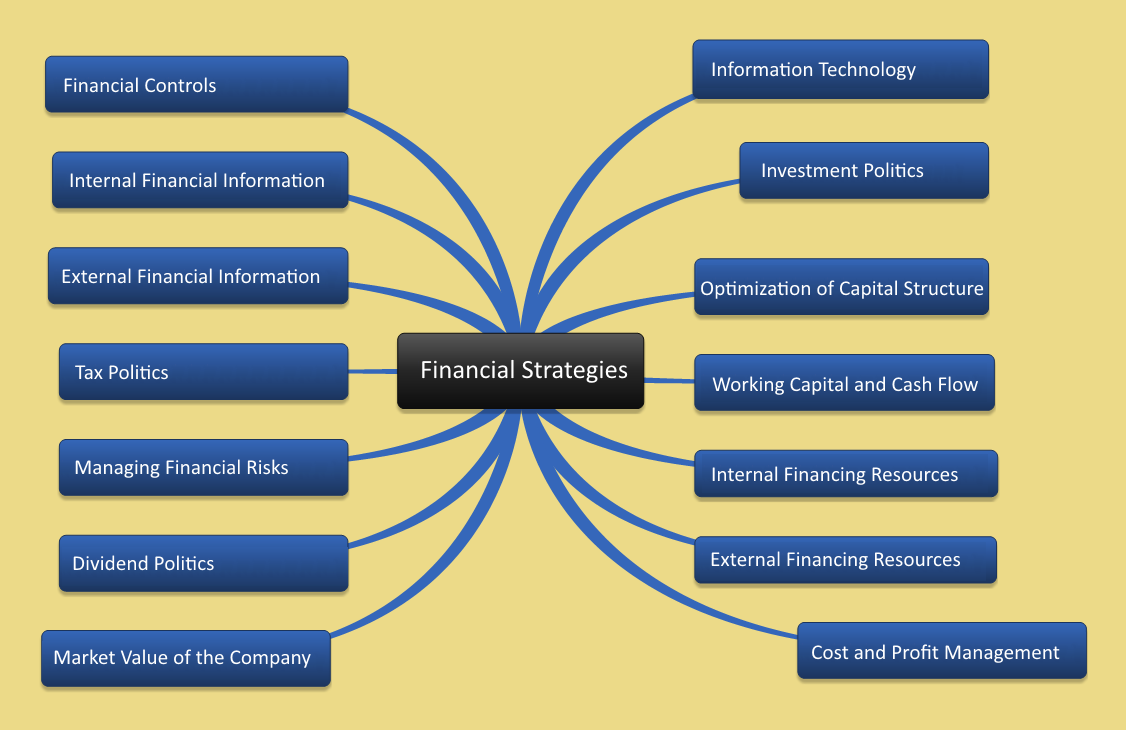

| Strategic Aspects for Financial Strategy |

What to Consider |

| Information Technology |

What are the requirements for the information system? Which functions should it perform in terms of the company’s needs? Typically, these are (Červený et al. – manuscript, anticipated publication date: 2015):

- Financial Accounting: general ledger, receivables, payables, cash, electronic banking, consolidation

- Managerial Accounting: cost center accounting, profit centers, cost accounting for orders and project accounting, process management, managerial financial statements, activity-based costing support

- Controlling: management of costs, revenues, resources and schedules, analyses, dashboards, KPI monitoring, assessing plans in relation to real situations

- Accounting and management of fixed assets, planning and monitoring of non-finalized investments

- Cash management, liquidity forecasting, cash flow planning, financial planning and budgets, risk management, foreign exchange transactions and security transactions

- Calculating and paying wages

- Record-keeping using other accounting standards (IFRS, US GAAP, etc.)

- Accounting using foreign currencies and exchange rates etc.

|

| Financial Controls |

- What type of financial controls (in terms of risks, costs etc.) should be implemented?

- Are the current financial controls set up appropriately with regard to the needs of the company?

- Control mechanisms for the following aspects should be addressed (adapted from Červený et al. – manuscript, anticipated publication date: 2015):

- Reliability and integration of accounting and financial information

- Compliance with main financial policies, plans, procedures, legislature, regulations and contracts

- Protection of the company’s assets

- Economic and efficient utilization of company resources

- Fulfillment of financial plans and targets

|

| Internal Financial Information |

- What type of financial information (reports) should be monitored? What are the users’ needs? This could include:

- Basic performance parameters (targets) of the company – profit development, turnover, profit margins etc.

- Basic data about product and service sales

- Analysis of production variance (difference between estimates and actual net prices/costs of input products – direct/indirect wages, utilities, maintenance, analyses of other variable costs, productivity, depreciation, percentage of fixed production costs and administrative overhead etc.

- How and how often should the above be monitored?

- Where to source input data from (with feasible time and cost demands for processing), who will be responsible for creating reports?

- Who will these reports be intended for? With regard to company management, how will identified errors be handled?

- How to ensure the distribution and protection of data? (adapted from Červený et al. – manuscript, anticipated publication date: 2015)

|

| External Financial Information |

- For whom, in what form, using which channels (e.g. websites etc.) and to what extent should external financial information be prepared?

- How to ensure the provision of financial information in a timely and cost-effective manner?

- How to ensure that this information is prepared in compliance with accounting and book-keeping regulations?

- Is it necessary to have an external auditor audit financial statements? If so, are the audits being carried out properly and in a timely fashion?

- What type of external information should be provided? (adapted from Červený et al. – manuscript, anticipated publication date: 2015)

|

| Investment Politics |

- Whether to invest and what to invest in?

- When to invest?

- Where to draw investment funds from?

- How to assess investments?

- How to prepare an investment plan? (adapted from Červený et al. – manuscript, anticipated publication date: 2015)

|

| Optimization of Capital Structure |

- In terms of cost and risk potential, what is the optimal level of indebtedness for the company?

|

| Working Capital and Cash Flow |

- What is the optimal amount of working capital (e.g. inventory) in terms of the rate of production, sales, etc.?

- How to manage cash flow?

- How to manage debt collection?

- How to manage short-term commitments?

- How to manage and optimize financial assets? Etc.

(adapted from Červený et al. – manuscript, anticipated publication date: 2015) |

| Internal Financing Resources |

- How to create and work with internal financing resources? These primarily include:

- Retained income

- Depreciation

- Changes in capital structure

- Reserves and reserve funds

- Financing with capital contributions (Sedláček, 2001)

- Will we select linear or accelerated depreciation of fixed assets?

- How to set up accounting depreciation in terms of tax write-offs?

- Is depreciation the source of simple reproduction or also the expanded reproduction of worn assets?

- Have activities been broken down into those that are necessary and unnecessary?

- How are individual assets utilized?

- What is the profitability of individual assets?

- Can these be converted into profitable assets?

- Is it necessary to create reserve funds? For what purpose?

- Is it possible that liabilities are being overestimated when creating reserve funds?

- Is reserve discounting performed in the event that time value of money becomes relevant?

- Are future developments in the areas of legislation and technology taken into consideration?

- Are reserves audited every year, ensuring that their size is appropriate and justified?

- Have reserves been used for their intended purpose?

- What is the equity level?

- Is it more beneficial to raise equity by increasing basic capital or by contributing to other capital funds? (adapted from Červený et al. – manuscript, anticipated publication date: 2015)

|

| External Financing Resources |

- Whether and (possibly) which external financing resources should the company use? e.g. (adapted from Červený et al. – manuscript, anticipated publication date: 2015):

- Bank loans

- Supplier loans: the supplier does not require immediate payment

- Down payments: payments made by the customer when ordering goods or services

- Obligations towards employees: wages due or in-house bank

- Obligations towards the state budget

- Bonds, obligations

- Promissory note program: issuing short-term securities in the form of promissory notes

- Subsidies: support from the government or state

- Donations

- Factoring – purchasing, financing, administration and collection of receivables for the delivery of goods or services. It is carried out by specialized financial institutions.

- Forfaiting- purchasing secured medium or long-term export receivables, carried out by specialized financial institutions without recourse to the original creditor.

- Leasing – primarily the lease of movables, provided by financial institutions.

- Alternative financing options:

- Business Angel – An investor who provides capital for start-up SMEs with growth potential, with the intention of assessing invested capital. The investor provides the company with know-how, usually entering in the early stages of the company’s creation.

- Venture capital – A capital fund provided to early-stage, start-up companies, meant to increase the company’s base capital. Sales are projected for a 3-7 year time-frame, with an estimated 30% p.a. interest rate

- Non-debt financing – e.g. credit unions

- Business incubators – specialized institutions that offer advantageous loans and leasing etc.

- Project funding: funding specific projects, regardless of current business operations, as in the future they will generate their own revenue – can be divided into SPVs- Special Purpose Vehicles

Criteria for selecting an external financing source (adapted from Červený et al. – manuscript, anticipated publication date: 2015):

- What is the legal status of the external financing provider?

- What is the maturity of capital?

- Where do the sources come from?

- Is the time factor taken into account?

- Is the risk factor taken into account?

- How much does the capital cost?

- How flexible are individual external financing sources?

- What administrative processes are connected to the provision of external financing?

- What is the competition like in terms of providing the given type of financing?

|

| Cost and Profit Management |

- What are the company’s cost and profit targets?

- Which methods should be employed for monitoring target fulfillment and how often should it be carried out?

- How to manage and control company costs? (time-sensitive budgets and monitoring expenditure, optimization of cost structure, financial calculations when launching new products and services etc.)

|

| Tax Politics |

- How to optimize tax deductions and tax politics? (taking advantage of tax relief, creating reserves and adjustments, creating offshore companies in compliance with ethical standards, tax-efficient legal structures in the company, optimization of company groups, mergers and acquisitions etc.) (adapted from Červený et al. – manuscript, anticipated publication date: 2015)

|

| Managing Financial Risks |

- Approach to managing the following risks:

- Credit risk

- Liquidity risk

- Interest rate risk (changes in interest rates)

- Foreign exchange risk - changes in exchange rates

- Financial derivatives (options, futures and swaps)

- Property damage liability

- Property risk

(adapted from Červený et al. – manuscript, anticipated publication date: 2015) |

| Dividend Politics |

- What type of dividend politics will the company enforce? What will be its approach to profit redemption, creating reserves etc.?

|

| Market Value of the Company |

- How to manage and increase the company’s market value in terms of the company’s financial strategy?

- How to address estimates of the company’s market value?

|